July 21, 2022

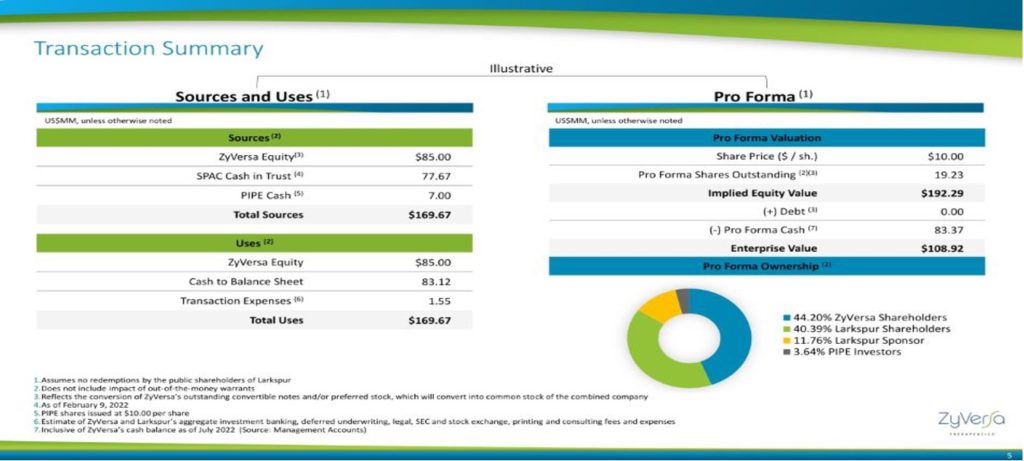

- Larkspur Health Acquisition Corp. (LSPR) to acquire ZyVersa Therapeutics (private) in a transaction valuing the pro forma entity at $108.92 million in Enterprise value ($192.29 million of equity value)

- 8.5 million shares of Larkspur common stock @10.00/share will be issued to ZyVersa stockholders as Merger Consideration.

- Transaction is supported by $7 million of Convertible Preferred Stock PIPE @$1000/share (7,000 shares of Series A Preferred Stock & warrants).

- No minimum cash condition.

- Business combination transaction is targeted to close in the fourth quarter of 2022.

- SPAC Details:

- Unit Structure: 1 share of Class A Common Stock + 0.75 Redeemable Warrant

- #Cash in Trust: $78,452,760 (101.0 % of Public Offering)

- Public Shares Outstanding: 7,767,159 shares

- Private Shares Outstanding: 2,262,062 shares (including 320,272 shares contained in Units)

- Reported Trust Value/Share: $10.10

- Liquidation Date: December 23, 2022

- Outside Liquidation Date: June 23, 2023

- Name of Target: ZyVersa Therapeutics

- Target Description: ZyVersa is a clinical stage specialty biopharmaceutical company leveraging advanced, proprietary technologies to develop product candidates that address unmet medical needs in the areas of renal and inflammatory diseases. ZyVersa’s development pipeline includes phase 2a ready VAR 200, a cholesterol efflux mediator for treatment of rare kidney disease, focal segmental glomerulosclerosis. ZyVersa believes VAR 200 has the potential to treat other glomerular diseases, including Alport Syndrome and Diabetic Kidney Disease. ZyVersa’s development pipeline also includes IC 100, a novel inflammasome ASC inhibitor being developed to treat a multitude of inflammatory diseases.

- Announced Date: July 21, 2022

- Expected Close: “Fourth quarter of 2022”

- Press Release: https://www.sec.gov/Archives/edgar/data/1859007/000121390022040769/ea163113ex99-1_larkspur.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1859007/000121390022040769/ex99-2_004.jpg & https://www.sec.gov/Archives/edgar/data/1859007/000121390022040769/ex99-2_005.jpg):

- Enterprise Value: $108.92 million

- Market Cap Value: $192.29 million

- Target shareholders Receive: $85 million of equity consideration @10.00 per share (subject to bridge financing adjustments)

- PIPE / Financing:

- $7 million of Convertible Preferred Shares & Warrants PIPE (7,000 Series A Preferred Shares @1000 per share and warrants in an amount equal to 100% of the underlying shares of common stock issuable upon conversion of such preferred stock)

Condition attached:

- Target must raise Additional Interim Financing of $3 million by August 31, 2022

- Right to terminate if the PIPE not closed by December 31, 2022

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Lock-up:

- Key Target shareholders: 180 days post-closing

- Founder shares: 180 days post-closing

- Early release from Lock-up: If the share price equals or exceeds $12.00 per share (90 days post-closing)

- Representative shares: 180 days after the effective date of registration statement

- Closing Conditions:

- Termination Date: December 15, 2022

- No minimum cash condition

- Completion of private placement

- Target shall have purchased a prepaid tail policy with respect to the D&O Insurance

- Other customary closing conditions

- Termination:

- No termination fees

- Standard termination clauses

- Advisors:

- Target Financial Advisors: The Benchmark Company LLC and Noble Capital Markets, Inc

- SPAC Financial Advisors: Alliance Global Partners

- Target Legal Advisors: Lowenstein Sandler LLP

- SPAC Legal Advisors: Alston & Bird LLP

- Alliance Global Partners Legal Advisor: Manatt, Phelps & Phillips, LLP

- Financials (N/A):

- No historical or projected financials provided

- Equity Incentive Plan:

- 10,085,000 shares of common stock are reserved

*Denotes estimated figures by CPC

#Reported as on March 31, 2022