September 28, 2022

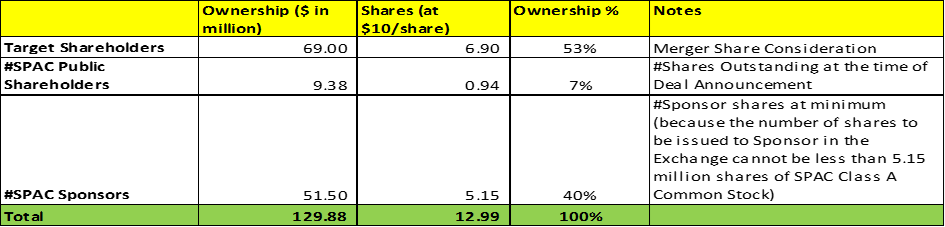

- KINS Technology Group Inc. (KINZ) to acquire CXApp Holding Corp., a subsidiary of Inpixon (NASDAQ: INPX) in a transaction valuing the pro forma entity at enterprise value of *$120.38 million (*$129.88 million of equity value).

- CXApp shareholders will receive an aggregate merger consideration of $69 million at $10.00 per share (10% KINS Class A Common Stock+ 90% KINS Class C Common Stock).

- Sponsor agrees to exchange 6,150,000 shares of KINS Class B Common Stock for a number of KINS Class A Common stock such that the total shares issued to Sponsor, Blackrock, non-redeeming shareholders, and non-redemption/financing transactions will equal to *6,899,999 i.e. Blackrock is fixed at 750,000 shares (subject to forfeiture back to Sponsor). Therefore, Sponsor will receive more KINS Class A Common Stock if trust redemptions are higher. However, the number of shares issued to Sponsor in exchange should not be less than 5,150,000 shares of KINS Class A Common Stock.

- Minimum gross cash condition of $9.50 million.

- The agreement includes a bilateral termination fee of $2.0 million payable under certain circumstances.

- 50% of the 3- month extension cost (not exceeding $250,000) shall be provided by Inpixon in the form of a working capital loan to KINZ if the merger is not consummated by December 16, 2022.

- The business combination is expected to close in the fourth quarter of 2022.

- SPAC Details:

- Unit Structure: One share of Class A common stock + 0.5 Redeemable Warrant

- #Cash in Trust: $9,528,176 (101.6% of Public Offering)

- Public Shares Outstanding: 938,090 shares

- Private Shares Outstanding: 6,900,000 shares

- Reported Trust Value/Share: $10.16

- Liquidation Date: June 17, 2022

- Outside Liquidation Date: December 16, 2022 (extended on June 13, 2022)

- Name of Target: CXApp Holdings (Parent: INPIXON)

- Announced Date: September 26, 2022

- Expected Close: “Fourth Quarter of 2022”

- Transaction Terms (N/A):

- Enterprise Value: *$120.38 million (Equity Value – Minimum Cash = *$129.88 million – $9.50 million)

- Market Capitalization: *$129.88 million

- Target Shareholders Receive:

- $69 million of KINS Capital stock shares (6.90 million shares at $10.00/share) as follows:

- 10% KINS Class A Common Stock (no lock-up)

- 90% KINS Class C Common Stock (identical to Class A except subject to lock-up)

- $69 million of KINS Capital stock shares (6.90 million shares at $10.00/share) as follows:

- PIPE / Financing:

- None

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- Sponsor owns 6,1500,000 shares and Blackrock owns 750,000 shares of KINS Class B Common Stock

- Blackrock will forfeit 525,000 shares back to Sponsor under certain conditions (not disclosed)

- Lock-up:

- SPAC Sponsors & Insiders (90%): 180 days post-closing

- Early Release: If the price is equal or above $12.00 per share after closing

- Note: 10% founder shares are not subject to a lock-up

- Early Release: If the price is equal or above $12.00 per share after closing

- Target Shareholders (Shares of Class C Common Stock): 180 days post-closing

- Early Release: If the price is equal or above $12.00 per share after closing

- SPAC Sponsors & Insiders (90%): 180 days post-closing

- Closing Conditions:

- Termination date: December 16, 2022 (March 16, 2023 with 3-months Extension)

- Cost of extension:

- Target parent will provide 50% of the extension amount to SPAC in the form a working capital loan

- Extension amount shall be determined by SPAC & should not exceed $250,000

- Cost of extension:

- Completion of transactions in the Separation and Distribution Agreement

- Gross Minimum Cash Condition of $9.5 million

- Cash includes:

- Cash in Trust

- Any equity financing (including convertible into equity) actually received by SPAC and/or Target

- Cash includes:

- PCAOB Financial Statements by November 14, 2022

- Other customary closing conditions

- Termination date: December 16, 2022 (March 16, 2023 with 3-months Extension)

- Termination:

| Target Termination Fee (plus interest) payable to SPAC if there is: Target’s breach of representations, warranties, covenant, agreement etc.Failure to obtain stockholder approval | SPAC Termination Fee (plus interest) payable to SPAC if there is: Target’s breach of representations, warranties, covenant, agreement etc.Uncured breach by Sponsor of its obligations |

| $2.00 million | |

- Other standard termination clauses

- Advisors:

- Target Legal Advisors: Mitchell Silberberg and Knupp LLP

- SPAC Legal Advisors: Skadden, Arps, Slate, Meagher and Flom LLP

- Financials(N/A):

- No financials provided

- Comparables(N/A):

- No Valuations provided

- Equity Incentive Plan:

- No information provided

*Denotes estimated figures by CPC

#Reported as on June 30, 2022