October 16, 2022

- Blockchain Moon Acquisition Corp. (BMAQ) to acquire DLTx (OSX: DLTX) in a transaction valuing the pro forma entity at $163.35 million in Enterprise value ($106.6 million equity value)

- DLTx shareholders will receive $106.6 million of merger consideration at $10/share including 6 million of earnout shares.

- Sponsor has agreed to forfeit 390,000 sponsor shares (11.8%), 19,500 warrants (4.53%) and 39,000 rights (9.07%) for no consideration at closing.

- Minimum net cash condition of $10 million.

- DLTx shall reimburse BMAQ for any expense in connection with the agreement not exceeding $7.5 million if the same is terminated.

- The period to consummate business combination is extended for a period of 3 months from October 21, 2022 to January 21, 2023. Additionally, BMAQ may elect to extend the time for another 6-months period to July 21, 2023 by resolution of MCAG’s board of directors.

- Business combination transaction is expected to be completed in the summer of 2023.

- SPAC Details:

- Unit Structure: 1 share of common stock + 1 Redeemable Warrant exercisable into ½ of a share + 1 Right to receive 1/10th of a share

- #Cash in Trust: $115,834,156 (100.7% of Public Offering)

- Public Shares Outstanding: 11,500,000 shares

- Private Shares Outstanding: 3,305,000 shares (including 430,000 shares contained in Units)

- Reported Trust Value/Share: $10.07

- Liquidation Date: October 21, 2022 (As of transaction announcement, BMAQ was seeking an extension to January 21, 2023 with 6 optional 1-month extensions; Succeeded on 10/21/2022 and 1,775,892 public shares remain post redemption)

- Name of Target: DLTx

- Description of Target: DLTx is a vertically integrated technology company expanding Web 3 capabilities by deploying blockchain infrastructure at scale across major global industries. The DLTx team is comprised of decentralists who believe in the new economy that’s powered by cryptographic digital assets. The DLTx team has been at the forefront of developing and launching several of the most important protocols in the blockchain space including Ethereum, developed the first blockchain investment fund in 2014, has built out massive scale mining infrastructure since 2015, and now operates the first publicly traded company focused on powering Web 3.

- Announced Date: October 14, 2022

- Expected Close: “Summer of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1867757/000110465922109036/tm2228249d1_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1867757/000110465922109430/tm2228373d1_425img06.jpg):

- Enterprise Value: $163.35 million

- Market Capitalization: $106.6 million

- SPAC Shareholders Receive:

- *1.78 million New BMAQ Common shares in exchange of BMAQ Shares

- *11.5 million New BMAQ warrants in exchange for BMAQ Warrants

- *1.15 million New BMAQ Common shares in exchange for BMAQ Rights

- Target Shareholders Receive:

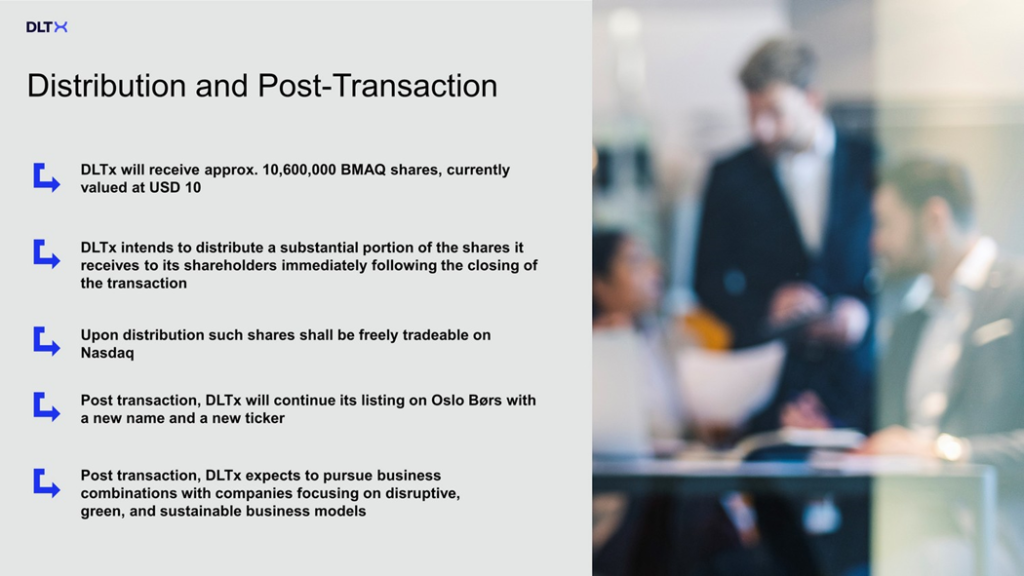

- 10.6 million shares of New BMAQ at $10.00 per share (value equal to the equity value of the acquired DLTx business)

- Includes 6 million earn out shares (subject to adjustment)

- 10.6 million shares of New BMAQ at $10.00 per share (value equal to the equity value of the acquired DLTx business)

- PIPE / Financing:

- None

- Redemption Protections:

- None

- Support Agreement:

- Standard voting support

- At closing, sponsor equity interest shall be forfeited for nil consideration:

- 240,000 Shares (7.26%), 19,500 Warrants (4.53%) and 39,000 Rights (9.07%)

- 150,000 Shares (4.54%) – Certain equity interests held by Villani (Chairman, Chief Executive Officer, and Director)

- Reserved for issuance to the employees of the Group Companies post-closing

| Sponsor Shares | |

| Total Founder shares | 2,875,000 |

| Common shares in Private Placement Units held by Sponsor | 430,000 |

| Total Common stock | 3,305,000 |

| Forfeited (shares) | 240,000 + 150,000 |

| *Forfeiture (%) | 7.26% + 4.54% |

| Sponsor Warrants | |

| Total Warrants in Private Placement Units held by Sponsor | 430,000 |

| Forfeited (warrants) | 19,500 |

| *Forfeiture (%) | 4.53% |

| Sponsor Rights | |

| Total Rights in Private Placement Units held by Sponsor | 430,000 |

| Forfeited (rights) | 39,000 |

| *Forfeiture (%) | 9.07% |

- Lock-up:

- SPAC Sponsor: 6 months post-closing

- Early Release (50%): If the price equals or exceeds $12.50 per share after closing

- Target shareholders: 6 months post-closing

- SPAC Sponsor: 6 months post-closing

- Closing Conditions:

- Termination date: July 21, 2023

- Minimum Net cash condition of $10 million

- Other customary closing conditions

- Termination:

- Reimbursement of expenses not exceeding $7,500,000 (payable to SPAC) if agreement is terminated due to:

- Target shareholder approval not obtained

- Target Change in Recommendation

- Entering into a definitive Company Acquisition Agreement resulting in a transaction that is more favorable to the Target shareholders than the transactions contemplated by agreement

- Other standard termination clauses

- Reimbursement of expenses not exceeding $7,500,000 (payable to SPAC) if agreement is terminated due to:

- Advisors:

- SPAC Financial Advisor: SGI Securities and Chardan Capital Markets

- Target Legal Advisors: Reed Smith LLP, DLA Piper LLP and Advokatfirmaet CLP, DA

- SPAC Legal Advisors: Kirkland & Ellis LLP and Advokatfirmaet Thommessen AS

- Target Auditor: Marcum LLP and Plus Revisjon AS

- SPAC Auditor: BDO US, LLP

- Special Committee Legal Advisor: Richards Layton & Finger

- Financials (N/A):

- No financials provided

- Comparables (N/A):

- No Valuations provided

- Equity Incentive Plan:

- Share reserve = 10% of New BMAC Common Shares outstanding post-closing (or such other number as Target and SPAC may mutually agree before Closing)

- Annual increase percentage will be decided mutually by Target and SPAC before Closing

*Denotes estimated figures by CPC

#Reported as on September 30, 2022