- Excelfin Acquisition Corporation (XFIN) to acquire Baird Medical (Private) in a transaction valuing the pro forma entity at $370 million in Enterprise Value ($370 million equity value) assuming 50% redemptions from the current level of 79.1%.

- Baird Medical shareholders will receive an equity consideration of $300 million at $10.2 per share.

- Sponsors will receive 4.5 million shares in the combined company, 30% of which shall be in the form of earnout vesting at $12.5 during 5-years after closing.

- The Sponsor also agreed to forfeit *11.7 million private warrants (or *100%).

- Minimum gross cash condition of $15.00 million.

- Agreement includes a Break-up fee of up to $6.00 million payable by Baird subject to certain conditions.

- Business combination transaction is targeted to close in the fourth quarter of 2023.

- SPAC Details:

- Unit Structure: 1 Class A Common Share + 0.5 Redeemable Warrant

- #Cash in Trust: $50,600,000 (105.7 % of Public Offering)

- Public Shares Outstanding: 4,788,792 shares

- Private Shares Outstanding: 5,750,000 shares (Including 1.255 million shares that will be transferred as part of Non- Redemption Agreement)

- Estimated Trust Value/Share: $10.57

- Current Liquidation Date: October 25, 2023

- Outside Liquidation Date: October 25, 2023

- Name of Target: Baird Medical

- Target Description: Established in 2012 and headquartered in Guangzhou, China, Baird Medical is a leading microwave ablation (MWA) medical device developer and provider in China. Baird Medical’s proprietary MWA medical devices are used for the treatment of benign and malignant tumors including thyroid nodules, liver cancer, lung cancer and breast lumps. Baird Medical is the first company to obtain Class III medical devices registration certificate for MWA medical devices specifically indicated for thyroid nodules in China.

- Announced Date: June 26, 2023

- Expected Close: “Fourth Quarter of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1852749/000110465923074571/tm2319015d1_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1852749/000110465923074571/tm2319015d1_ex99-2img041.jpg)

| Redemption Rate | 50% from current level of 79.1% |

| Share Price | $10.20 per share |

| Enterprise Value | $370 million |

| Market Cap Value | $370 million |

- SPAC Public Shareholders:

- *2,394,396 Pubco Ordinary Shares (1 for 1) assuming 50% redemptions

- SPAC Sponsors:

- * 4.50 million Pubco Ordinary Shares (1 for 1)Including 1.35 million as earnout shares (or *30%)Excluding 1.25 million transferred as per non-redemption agreement signed on 6th April for extension meeting

- Target Shareholders Receive (~*81.1%):

- Equity consideration of $300 million at $10.2 per share (29,411,764 shares of “Pubco Ordinary Share”)

- PIPE / Financing:

- Nil

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

- Sponsor agreed:

- to forfeit *11.7 million private placement warrant (or *100%)

- to subject 30% sponsor shares (or *1.35 million shares) to earnout @12.50 per share (5 years post-closing)

- Lock-up:

- SPAC Sponsors: 12 months post-closing

- Early Release: if price equals or exceeds 15.0 per share post-closing

- Key Target Shareholders:

- Merger shares: 6 months post-closing

- SPAC Sponsors: 12 months post-closing

- Closing Conditions:

- Termination date: October 25, 2023

- Consummation of PIPE Investment by closing

- Minimum gross cash condition of $15.0 million

- Cash includes:

| Cash in Trust | |

| Less: | Redemptions |

| Add: | PIPE Investment |

- Other customary closing conditions

- Termination:

- If closing conditions are not satisfied, Target shall pay a Break-Up Fee equal to the lesser of:

- total expenses incurred by the SPAC

- OR

- $6.00 million

- Other standard termination clauses

- If closing conditions are not satisfied, Target shall pay a Break-Up Fee equal to the lesser of:

- Advisors:

- SPAC Legal Advisors: Shearman & Sterling LLP

- Target Legal Advisors: Dechert

- SPAC Lead Financial Advisors: Cohen & Company Capital Markets

- SPAC Financial & Capital Markets Advisor: Exos Securities

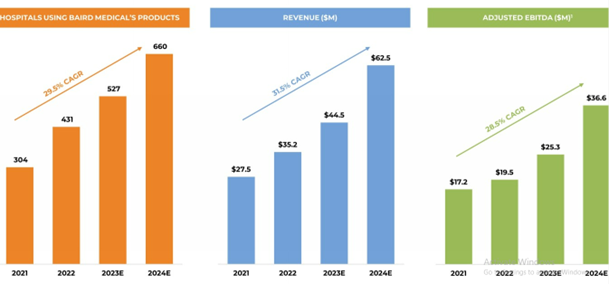

- Financials (https://www.sec.gov/Archives/edgar/data/1852749/000110465923074571/tm2319015d1_ex99-2img038.jpg):

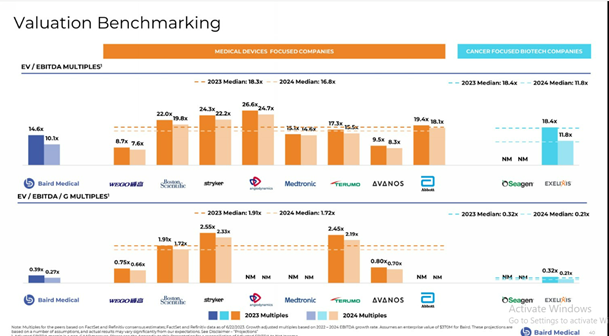

- Comparable (https://www.sec.gov/Archives/edgar/data/1852749/000110465923074571/tm2319015d1_ex99-2img040.jpg):

- Equity Incentive Plan:

- 10% shares of combined company at closing

*Denotes estimated figures by CPC

#Reported as on 13th April 2023 (Date of Special Meeting)