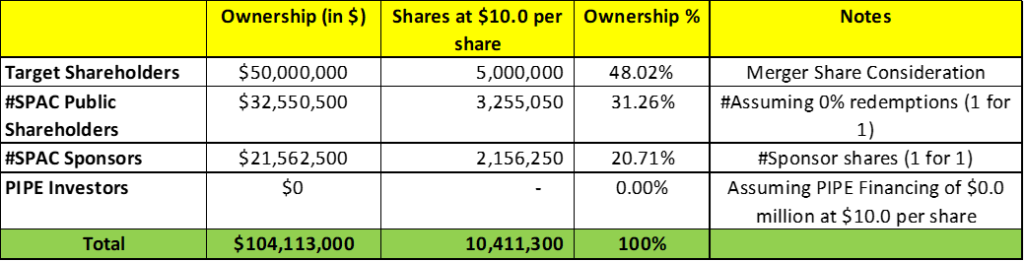

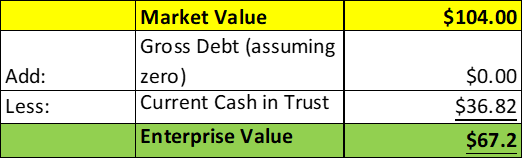

- Acri Capital Acquisition Corporation (ACAC) to merge with Foxx Development (Private) in a transaction valuing the pro forma entity at *$67.2 million in Enterprise Value (*$104 million of equity value assuming no further redemptions).

- Foxx shareholders will receive an equity consideration of $50.0 million at $10.0 per share and will also get up to 4.20 million as earnout shares upon achievement of certain financial performance milestones for the fiscal years ending June 30, 2024 and June 30, 2025.

- No minimum cash condition.

- No termination fees.

- Business combination transaction is targeted to close in the second quarter of 2024.

- SPAC Details:

- Unit Structure: 1 Share of Class A Common Stock + 0.5 Redeemable Warrant

- #Cash in Trust: $36,822,846 (~113.1% of Public Offering; including 2 extension payments of $75,000 each up to March 14, 2024

- Public Shares Outstanding: 3,255,050 shares

- Private Shares Outstanding: 2,156,250 shares

- Estimated Trust Value/Share: *$11.31 per share

- Current Liquidation Date: March 14, 2024

- Outside Liquidation Date: April 14, 2024

- Name of Target: Foxx Development Inc.

- Description of Target: Founded in 2017 as a Texas-incorporated entity, Foxx stands as a distinguished player in the realm of consumer electronics and integrated Internet-of-Things (IoT) solutions, catering to both retail and institutional clients. Leveraging its robust research and development capabilities, the company’s strategic vision focuses on forging enduring alliances with global mobile network operators, distributors, and suppliers. This approach has translated into a robust presence within the United States, where the portfolio encompasses a diverse range of mobile phones, tablets, and consumer electronics. Concurrently, Foxx is diligently engaged in the development and distribution of end-to-end communication terminals and an innovative suite of IoT solutions, with the aim of positioning itself at the forefront of technological advancement to shape the future of global connectivity.

- Announced Date: February 20, 2024

- Expected Close: “Second Quarter of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1914023/000121390024015067/ea193983ex99-1_acricapital.htm

- Transaction Terms (N/A):

- Transaction share price: $10.0 per share

- Pro Forma Equity Value: *$104 million

- Target Equity Consideration/ Target Shareholding

- $50.0 million/48.02%

- Target Equity Consideration/ Target Shareholding

- Pro Forma Enterprise Value: *$67.2 million

- Equity Value – CIT

- $104 million – $36.8 million

- Target Shareholders Receive (~48.02%):

- Equity consideration of $50.0 million at $10.0 per share

- 500,000 shares in aggregate will be deposited to a segregated escrow account

- Earnout Consideration of up to 4.20 million shares at $10.0 per share:

- Financial Performance for fiscal year ending June 30, 2024

- 0.70 million shares when 2024 Revenue equals or exceeds $67.0 million but less than $84.0 million

- 1.40 million shares when 2024 Revenue equals or exceeds $84.0 million but less than $100 million

- 2.10 million shares when 2024 Revenue equals or exceeds $100 million

- Financial Performance for fiscal year ending June 30, 2025

- 0.70 million shares when 2024 Revenue equals or exceeds $77.05 million but less than $96.6 million

- 1.40 million shares when 2024 Revenue equals or exceeds $96.6 million but less than $115 million

- 2.10 million shares when 2024 Revenue equals or exceeds $115 million

- Financial Performance for fiscal year ending June 30, 2024

- Equity consideration of $50.0 million at $10.0 per share

- PIPE / Financing:

- Nil

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Lock-up:

- SPAC Sponsor: 6 months post-closing

- Early Release: If price equals or exceeds $12.0 per share after closing

- Target Shareholders (Holdings >5%): 6 months post-closing

- Early Release: If price equals or exceeds $12.0 per share after closing

- SPAC Sponsor: 6 months post-closing

- Closing Conditions:

- Termination date: April 14, 2024

- No minimum cash condition

- Other customary closing conditions

- Termination:

- No termination fee

- Other standard termination clause

- Advisors:

- SPAC Capital Market Advisor: EF Hutton LLC

- Target Legal Advisor: VCL Law LLP

- SPAC Legal Advisor: Robinson & Cole LLP

- Financials (N/A):

- No financials or projections provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan

- Plan Share Limit equal to 20% of shares of combined company at closing

- provided the issuance, which includes any converted options from pre-existing options of Foxx before closing within one year of closing, must not exceed 50% of the Plan Share Limit

- Plan Share Limit equal to 20% of shares of combined company at closing

*Denotes estimated figures by CPC

#Estimated as on February 20, 2024