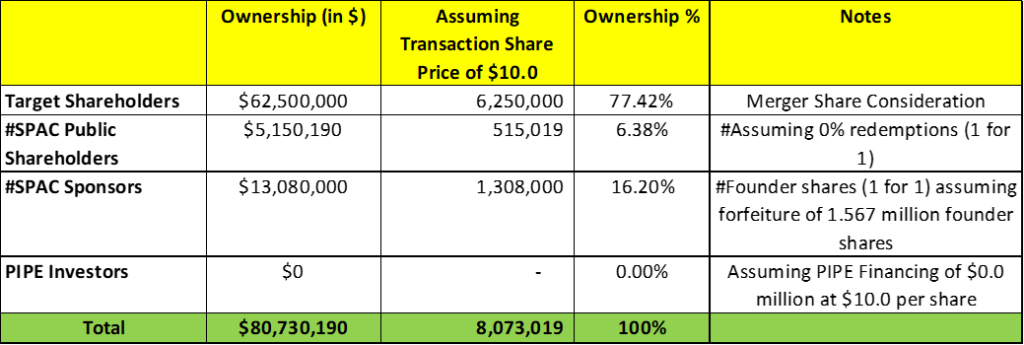

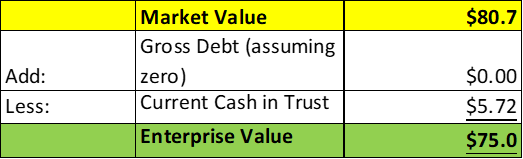

- Moringa Acquisition Corp (MACA) to acquire Silexion (Private) in a transaction valuing the pro forma entity at *$75.0 million in Enterprise Value (*$80.7 million of equity value assuming no further redemptions).

- Silexion shareholders will receive an equity consideration of $62.5 million at $10.0 per share.

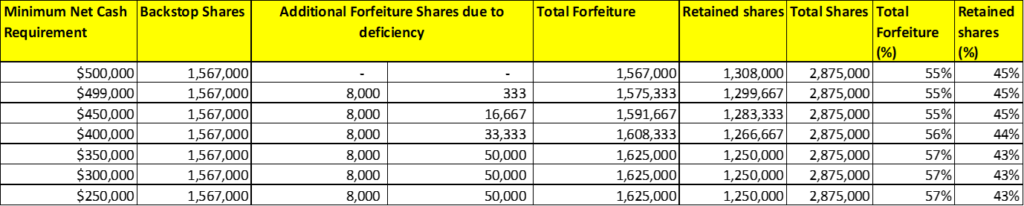

- Sponsor agreed to forfeit 1.57 million founder shares (or *55%) at closing, with provisions for forfeiting additional shares if the closing net cash falls below $0.50 million, including 8,000 extra founder shares and 333⅓ founder shares for every $1,000 shortfall up to a maximum of $0.15 million, totaling up to 50,000 founder shares.

- Minimum net cash condition of $500,000 (or $350,000)

- No termination fees.

- Transaction is targeted to close in the third quarter of 2024.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.50 Redeemable Warrant

- #Cash in Trust: *$5,723,383 (~*111% of Public Offering; including 2 months extension payment of *$25,751 up to March 19, 2024)

- Public Shares Outstanding: 515,019 shares

- Private Shares Outstanding: 3,225,000 shares (including 350,000 shares underlying Private Units)

- Estimated Trust Value/Share: *$11.1 per share

- Current Liquidation Date: March 19, 2024

- Outside Liquidation Date: August 19, 2024

- Name of Target: Silexion

- Description of Target: Silexion Therapeutics is a pioneering clinical stage, oncology-focused biotechnology company dedicated to the development of innovative treatments for unsatisfactorily treated solid tumor cancers which have the mutated KRAS oncogene. The company conducted a Phase 2a clinical trial which has shown positive efficacy results in comparison to the control of chemotherapy alone. Silexion’s is committed to pushing the boundaries of therapeutic advancements in the field of oncology, and further developing its second generation product for locally advanced pancreatic cancer.

- Announced Date: February 22, 2024

- Expected Close: Third Quarter of 2024

- Press Release: https://www.globenewswire.com/news-release/2024/02/22/2833670/0/en/Silexion-a-Clinical-Stage-Oncology-Focused-Biotechnology-Company-to-Become-Publicly-Traded-Via-Business-Combination-with-Moringa-Acquisition-Corp.html

- Transaction Terms (N/A):

- Transaction share price: $10.0 per share

- Pro Forma Equity Value: *$80.7 million

- Pro Forma Enterprise Value: *$75.0 million

- Target Shareholders Receive (~*77.4%%):

- Equity consideration of $62.5 million at $10.0 per share (*6.25 million SPAC Class A Shares)

- PIPE / Financing:

- Nil

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Amendment and Restatement of Existing Sponsor Promissory Notes:

- At closing, SPAC will issue to Sponsor a new promissory note, which replaces all existing outstanding promissory notes with following specific terms:

- The total amount owed by SPAC to Sponsor is capped at $5.20 million – any fees or expenses owed (according to the Marketing Agreement)

- Any excess amount loaned by Sponsor will be considered additional paid-in capital when the note matures

- The maturity date is the 30-month anniversary of the closing date

- Amounts owed may only be repaid through conversion into SPAC Class A Shares

- At closing, SPAC will issue to Sponsor a new promissory note, which replaces all existing outstanding promissory notes with following specific terms:

- Sponsor agreed to forfeit 1.567 million founder shares (or *55%) at closing:

- If closing net cash is less than $0.50 million, sponsors will give up even more shares:

- extra 8,000 founder shares

- For every $1,000 less than $0.50 million, sponsor will give up 333⅓ founder shares, up to a maximum of $0.15 million

- A total of up to 50,000 founder shares

- If closing net cash is less than $0.50 million, sponsors will give up even more shares:

- Lock-up:

- SPAC Sponsor: 6-months post-closing

- Early release (50%): If the price equals or exceeds $12.0 per share post-closing

- Key Target Shareholders: Same as sponsor

- SPAC Representative Shares: 3 months post-closing

- SPAC Private Shares & Warrants: 30 days post-closing

- SPAC Sponsor: 6-months post-closing

- Closing Conditions:

- Termination date: August 19, 2024

- Minimum net cash condition of $0.50 million

- Subject maximum allowable deficiency of $0.15 million (or net cash of *$0.35 million)

- Cash means unrestricted & ready for use by the combined company

- Forfeiture by SPAC Sponsor of 1.567 million Founders Shares, such that they will hold 1.31 million Founders Shares

- subject to an increased forfeiture, if the amount of unrestricted & freely usable cash in SPAC’s bank account at closing is less than $0.50 million

- PCAOB financials by February 15, 2024

- SPAC must provide the Target with a certified list of its liabilities that should cover any liabilities not included or exceeding those disclosed in SPAC’s recent financial statements with following details:

- Remaining fees or expenses from the Marketing Agreement

- Final amount owed on the A&R Sponsor Promissory Note, after additional injections to meet the SPAC Minimum Net Cash Requirement (See closing conditions) and within the Promissory Note Cap (See sponsor support)

- Expenses related to the Agreement’s transactions, such as legal and accounting fees

- Provided these liabilities (excluding Marketing Agreement fees) must not exceed $1.00 million assuming the deal closes by August 19, 2024

- SPAC should have received all the signed subscription agreements for the Convertible Loan Financing and Target has received at least $3.50 million in proceeds from those agreements by March 10, 2024

- Other customary closing conditions

- Termination:

- No termination fee

- Agreement can be terminated by SPAC before April 2, 2024 if following two conditions are not met by March 10, 2024:

- SPAC doesn’t receive all the signed subscription agreements for the Convertible Loan Financing

- Target doesn’t receive at least $3.50 million in proceeds from those agreements

- Other standard termination clause

- Advisors:

- SPAC Legal Advisor: Meitar | Law Offices and Greenberg Traurig

- Target Legal Advisor: Herzog Fox & Neeman

- Financials (N/A):

- No financials or projections provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan

- SPAC Board will adopt the New Incentive Plan & create the New Incentive Plan Pool

*Denotes estimated figures by CPC

#Estimated as on February 22, 2024