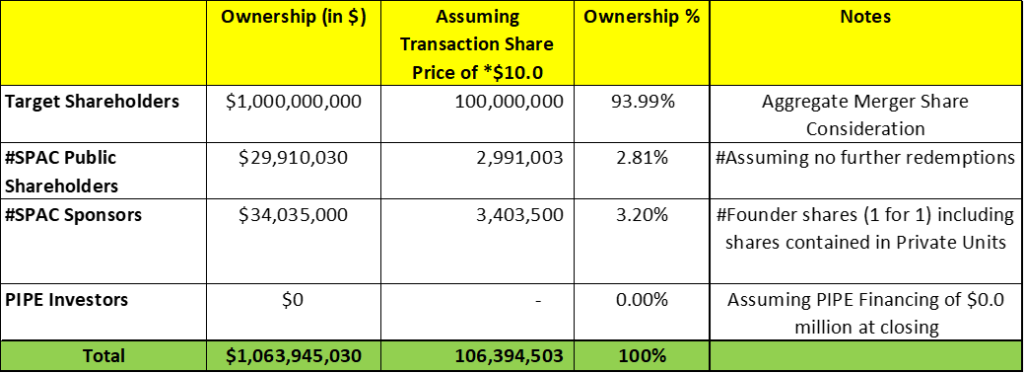

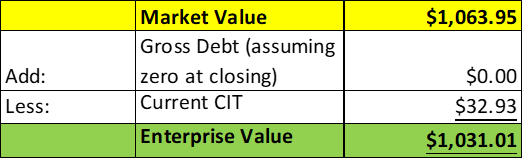

- Aetherium Acquisition Corp (GMFI) to merge with Capital A International (Kuala Lumpur Stock Exchange: 5099.KL) in a transaction valuing the pro forma entity at *$1,031 million in Enterprise Value (*$1,064 million of equity value assuming no further redemptions).

- The Sponsor has agreed to reimburse GMFI for expenses incurred, transfer sponsor shares to GMFI for Excise Tax Amount, and convert working capital loans into GMFI Units (up to a maximum of $1.50 million) at closing or forgive them (if applicable).

- No minimum cash condition.

- No termination fees.

- GMFI must have secured the novation or waiver of deferred underwriting fees.

- Business combination transaction is targeted to close in the second half of 2024.

- SPAC Details:

- Unit Structure: 1 share of Class A Common Stock + 1 Redeemable Warrant

- #Cash in Trust: $32,930,943 (~110.1% of Public Offering)

- Public Shares Outstanding: 2,991,003 shares

- Private Shares Outstanding: 3,403,500 shares (including 528,500 shares contained in Private Units)

- Reported Trust Value/Share: $11.01 per share

- Current Liquidation Date: April 3, 2024

- Outside Liquidation Date: April 3, 2024

- Name of Target: Capital A International

- Description of Target: Capital A International (CAPI) is a global brand management platform, specializing in the expansion, management and licensing of the AirAsia brand. To be led by Tony Fernandes, one of Asia’s most recognizable entrepreneurs, CAPI aims to capitalize AirAsia’s brand value through additional licensing and to deploy its proven strategy to promote and accelerate the expansion of its intellectual property portfolio. CAPI’s platform combines brand strategy, creative marketing and intellectual property development to effectively position its brands and establish cultural relevance among consumers.

- Announced Date: February 28, 2024

- Expected Close: “Second half of 2024”

- Press Release: https://newsroom.airasia.com/news/capital-a-international-owner-of-the-iconic-airasia-brand-to-be-publicly-listed-in-the-us-through-business-combination-with-aetherium-acquisition-corp#gsc.tab=0

- Transaction Terms (N/A):

- Transaction share price: $10.0 per share

- Pro Forma Equity Value: *$1,064 million

- Pro Forma Enterprise Value: *$1,031 million

- Target Shareholders Receive (~*94%):

- Equity consideration of $1,000 million at $10.0 per share (Aggregate consideration value is $1,150 million)

- PIPE / Financing:

- During the Interim Period, SPAC will work diligently to secure subscription agreements with investors for a private equity investment in SPAC or Pubco, acquiring PIPE Shares in a private placement:

- This includes potential backstop arrangements, all subject to mutual agreement

- During the Interim Period, SPAC will work diligently to secure subscription agreements with investors for a private equity investment in SPAC or Pubco, acquiring PIPE Shares in a private placement:

- Redemption Protections:

- No Redemption Protections

- Support Agreement:

- Standard voting support

- Sponsor agreed to:

- reimburse SPAC in cash for expenses paid by it (or its affiliates)

- transfer, directly or constructively (including pursuant to a forfeiture and reissuance), a number of sponsor shares to or as directed by SPAC in connection with Excise Tax Amount

- convert working capital loans at closing into SPAC Units (not exceeding $1.50 million) and/or forgive such amounts (if applicable)

- Lock-up:

- SPAC Sponsor: 6 months post-closing

- Early release: If the price equals or exceeds $12.0 per share after closing

- Key Target Shareholders: Not provided

- SPAC Sponsor: 6 months post-closing

- Closing Conditions:

- Termination date: December 31, 2024

- No minimum cash condition

- SPAC shall have obtained the Deferred Underwriting Fees Novation or Waiver

- Other customary closing conditions

- Termination:

- No termination fee

- Other standard termination clause

- Advisors:

- SPAC US Legal Advisor: Rimon P.C.

- Target US Legal Advisor: Greenberg Traurig, LLP

- Target Malaysian Legal Advisor: Foong & Partners

- Financials (N/A):

- No financials or projections provided

- Comparables (N/A):

- No valuations provided

- Equity Incentive Plan

- Equity Incentive Awards ≤ 15% of the number of Pubco Ordinary Shares outstanding at closing (pre-diluted basis)

*Denotes estimated figures by CPC

#Reported as on February 23, 2024 (Def. proxy for charter extension meeting)