June 24, 2023

- TLGY Acquisition Corporation I (TLGY) to acquire Verde Bioresins (Private) in a transaction valuing the pro forma entity at $433 million in Enterprise Value ($496 million equity value) assuming zero redemptions from the current level of 31.82%.

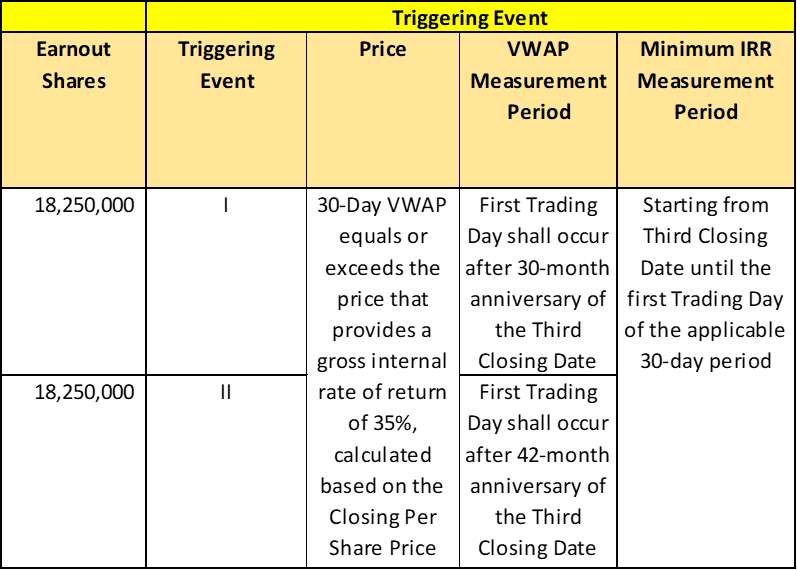

- Verde shareholders will receive an equity consideration of $365 million at $10.0 per share & earnout consideration equal to 100% of merger consideration in two equal tranches based on post-closing trading prices meeting specified IRR thresholds of 35% over 5 years.

- Humanitario Capital LLC (the current controlling stockholder of Verde) commits to investing in New Verde Common Stock at a price of $10.0 per share, with the total purchase price being lower of either $25.0 million or 10% of Institutional PIPE Proceeds, subject to certain conditions including TLGY securing commitments from financial institutional investors & not accepting subscriptions from strategic investors at closing.

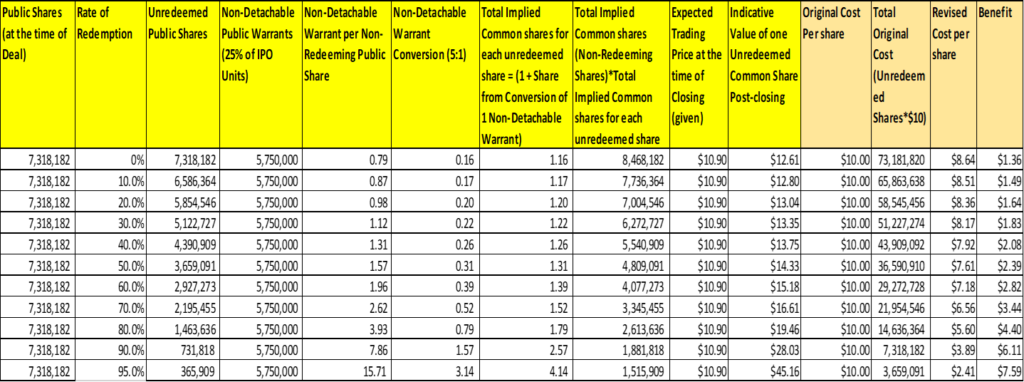

- In order to incentivize TLGY shareholders not to redeem, TLGY shall grant non-redeeming shareholders at closing an additional 5.75 million publicly tradable warrants (25% of original IPO shares) convertible at the ratio of 5:1.

- The Sponsor agrees to forfeit 10,733,550 Sponsor Warrants (*90.5% of total) & reserve 1,125,950 as Incentive Warrants (*9.5% of total) for Incentive Grantees, with a possibility of forfeiting up to 281,487 Incentive Warrants (25% of total) if the Sponsor determines that the Incentive Grantees did not make reasonable efforts to facilitate the transactions outlined in the Merger Agreement.

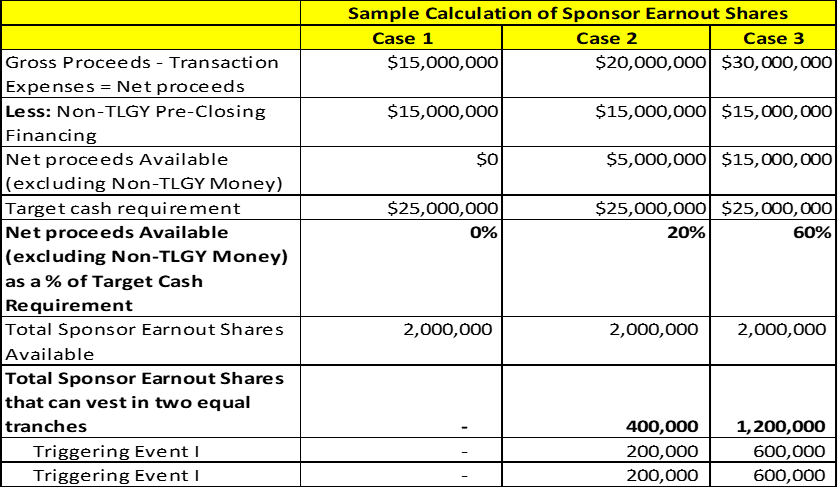

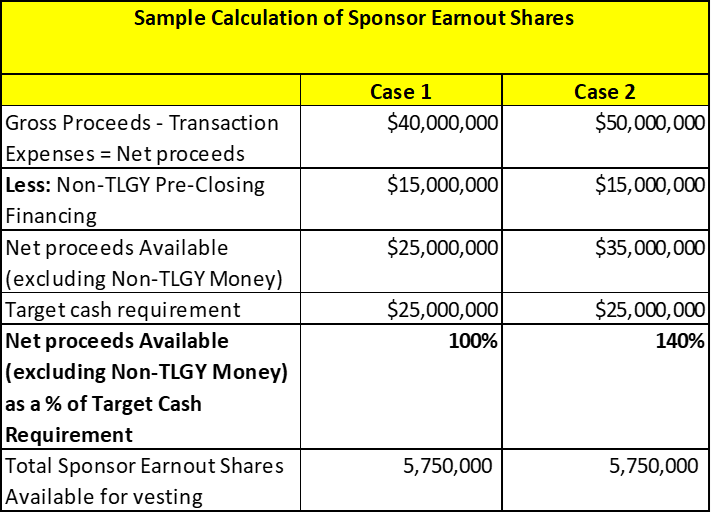

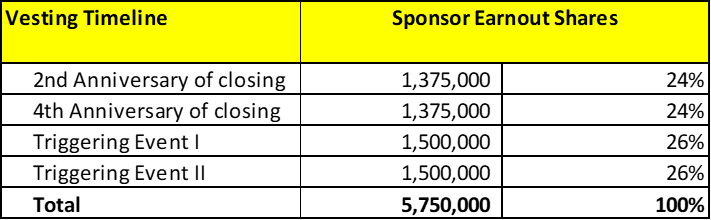

- If the Net Proceeds at the closing are below the Target Cash Requirement (or 25%), TLGY will issue up to 2.00 million Sponsor Earnout Shares to the Sponsor based on post-closing trading prices meeting specified IRR thresholds of 35% (same as Target Earnouts) over 5 years. If the Net Proceeds equal or exceed the Target Cash Requirement, TLGY will issue up to 5.75 million Sponsor Earnout Shares based on specific timelines & IRR threshold conditions.

- Minimum net cash condition of $15.0 million.

- No termination fees.

- Business combination transaction is targeted to close in the second half of 2023.

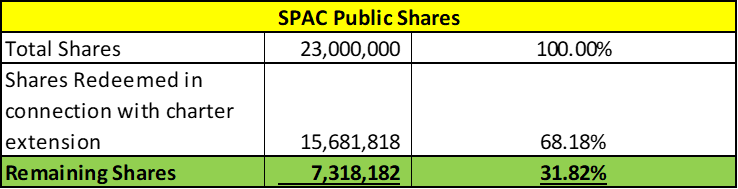

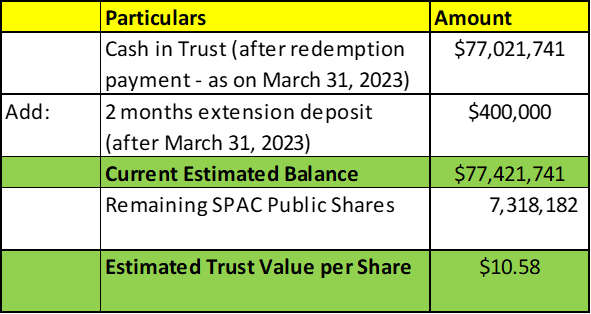

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.5 Detachable Redeemable Warrant + 0.25 Non-Detachable Warrants

- #Cash in Trust: $77,421,741 (105.8 % of Public Offering)

- Public Shares Outstanding: 7,318,182 shares

- Private Shares Outstanding: 5.75 million shares

- Estimated Trust Value/Share: $10.58

- Current Liquidation Date: August 3, 2023

- Outside Liquidation Date: December 3, 2023

- Name of Target: Verde Bioresins

- Target Description: Verde Bioresins, Inc. is a full-service bioplastics company that specializes in sustainable product innovation and the manufacturing of proprietary biopolymer resins, providing comprehensive design and development solutions for companies seeking alternatives to conventional plastics.

- Announced Date: June 22, 2023

- Expected Close: “Second Half of 2023”

- Press Release: https://www.sec.gov/Archives/edgar/data/1879814/000110465923073575/tm2319298d1_ex99-1.htm

- Transaction Terms (https://www.sec.gov/Archives/edgar/data/1879814/000110465923073575/tm2319298d1_ex99-2img023.jpg):

| Redemption Rate | 0% from current level of 31.82% |

| Share Price | $10.0 per share |

| Enterprise Value | $433 million |

| Market Cap Value | $496 million |

- Target Shareholders Receive (~73.6%):

- Equity consideration of $365 million at $10.0 per share (36.5 million shares of New Verde Common Stock)

- Earnout consideration of $365 million at $10.0 per share (5 years after closing):

- PIPE / Financing:

- PIPE: Humanitario commits to invest (subject to Institutional PIPE Proceeds) in New Verde Common Stock at $10.0 per share purchase for a total purchase price equal to the lower of:

- Subscription Amount: [$25.0 million OR 10%*Institutional PIPE Proceeds] – Proceeds invested by Humanitario in Verde in the form of equity or equity-linked securities during the interim period & unredeemed

- Institutional PIPE Proceeds: Humanitario’s obligation to make the PIPE Investment is subject to TLGY receiving commitments from one or more Financial Institutional Investors to purchase shares of the New Verde Common Stock at closing

- Humanitario shall not have any obligation to make the PIPE Investment if TLGY accepts a subscription at the Closing from one or more Strategic Investors

- Subscription Amount: [$25.0 million OR 10%*Institutional PIPE Proceeds] – Proceeds invested by Humanitario in Verde in the form of equity or equity-linked securities during the interim period & unredeemed

- PIPE: Humanitario commits to invest (subject to Institutional PIPE Proceeds) in New Verde Common Stock at $10.0 per share purchase for a total purchase price equal to the lower of:

- Redemption Protections (https://www.sec.gov/Archives/edgar/data/1879814/000110465923073575/tm2319298d1_ex99-2img025.jpg):

- TLGY will grant 5.75 million publicly tradable warrants (or 25% of number of IPO units = 25%*23.0 million) at a conversion ratio of 5:1

- Support Agreement:

- Standard voting support

- Sponsor agreed to forfeit 10,733,550 Sponsor Warrants (or *90.5%) & reserve the remaining 1,125,950 as Incentive Warrants (or *9.5%) for Incentive Grantees,

- Up to 281,487 of such Incentive Warrants (or *25% of Total Incentive Warrants) are subject to forfeiture if the Sponsor determines that the Incentive Grantees have not used reasonable efforts to facilitate the transactions (including cooperating with the Sponsor and TLGY to raise Net Proceeds)

- Incentive Grantees: Officers & employees of Verde providing services to it as of the date of the Merger Agreement & employed by Verde at the time of Grant to be determined at the Sponsor’s discretion primarily based on the work performed in facilitating the transactions

- Up to 281,487 of such Incentive Warrants (or *25% of Total Incentive Warrants) are subject to forfeiture if the Sponsor determines that the Incentive Grantees have not used reasonable efforts to facilitate the transactions (including cooperating with the Sponsor and TLGY to raise Net Proceeds)

- Sponsor Earnout Shares:

- (I) When Net Proceeds < Target Cash Requirement or $25.0 million

- Sponsor Earnout shares shall be computed in the following manner subject to the availability of maximum of 2.00 million shares of New Verde Common Stock

- (I) When Net Proceeds < Target Cash Requirement or $25.0 million

- (II) When Net Proceeds ≥ Target Cash Requirement or $25.0 million

- (III) Regardless of anything mentioned in (I) & (II), if within 30 days after the date of the Merger Agreement,

- Verde, Humanitario, or their related individuals or groups secure legally binding agreements from investors to invest $50.0 million or more in Verde or TLGY before closing, and if the total amount of binding investment agreements in Verde or TLGY before the Closing (excluding any funds held in the Trust Account) secured by the Sponsor, TLGY, or their related individuals or groups is less than $10.0 million, then the Sponsor will only receive the maximum number of Sponsor Earnout Shares specified (I) under “Sponsor’s Earnout,” assuming the Target Cash Percentage is 100% for the purpose of (I) & (II)

- Notes:

- Issuance of the Sponsor Earnout Shares pursuant to the occurrence of Triggering Event I shall no longer be applicable upon the satisfaction of Triggering Event II

- Upon the occurrence of Triggering Event II within the Earnout Period, 3.00 million Sponsor Earnout Shares shall be issued to the Sponsor such that the cumulative total of all Sponsor Earnout Shares issued pursuant to (a) and (b) shall be equal to 3,000,000 Sponsor Earnout Shares

- The meaning of Triggering Event I & Triggering Event II as defined in the case of Target Earnouts applies similar for the purpose of Sponsor Earnout Shares

- Lock-Up:

- SPAC Sponsors: 1-year post-closing

- Early Release: If the price equals or exceeds $12.00 per share after 150 days post-closing

- Key Target Shareholders:

- Merger shares: 180 days post-closing

- Earnout Shares: 3 months after Relevant Triggering events (Triggering Event I & II)

- Closing Conditions:

- Termination date: March 31, 2024

- Minimum net cash condition of $15 million

- Cash includes:

| Cash in Trust | Gross Proceeds | |

| Less: | Redemptions | |

| Add: | Founder PIPE Agreement | |

| Add: | Any Pre-Closing Financing (Whether paid before or after closing including Non-TLGY Pre-Closing Financing) | |

| Add: | Verde (& its subsidiaries) Cash & Cash Equivalents (excluding any cash already taken into account in Founder PIPE, or any cash proceeds from the Company Note)s | |

| Less: | All Transaction Expenses | |

| Net Proceeds | ||

- Verde’s closing Net Debt ≤ $5.0 million

- Other customary closing conditions

- Termination:

- No termination fees

- On termination, Verde will reimburse Humanitario for all its transaction expenses

- Other standard termination clauses

- Advisors:

- SPAC Legal Advisors: Cleary Gottlieb Steen & Hamilton LLP

- Target Legal Advisors: Wilmer Cutler Pickering Hale and Dorr LLP

- SPAC Auditor: Marcum Bernstein & Pinchuk LLP

- Target Auditor: EisnerAmper LLP

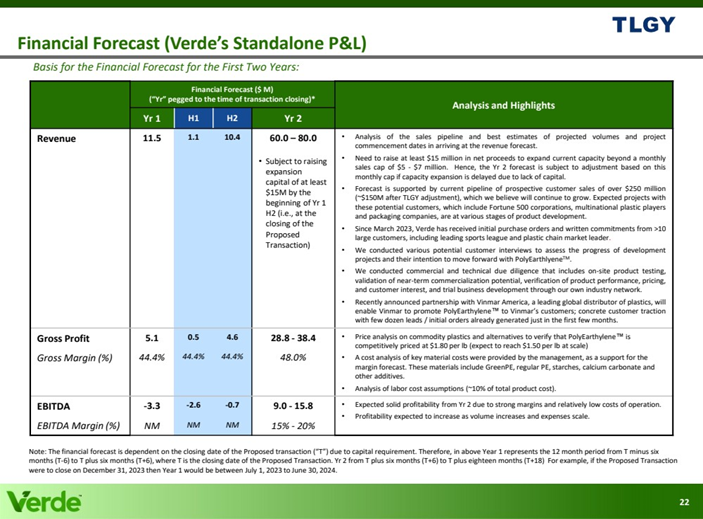

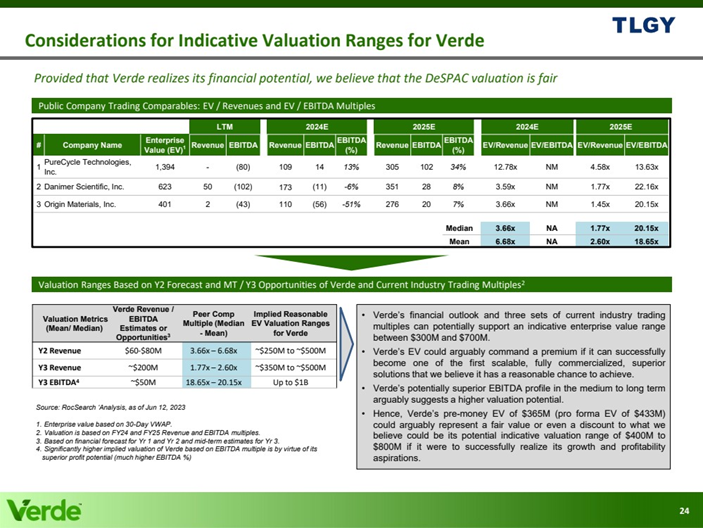

- Financials (https://www.sec.gov/Archives/edgar/data/1879814/000110465923073575/tm2319298d1_ex99-2img022.jpg):

- Comparables (https://www.sec.gov/Archives/edgar/data/1879814/000110465923073575/tm2319298d1_ex99-2img024.jpg):

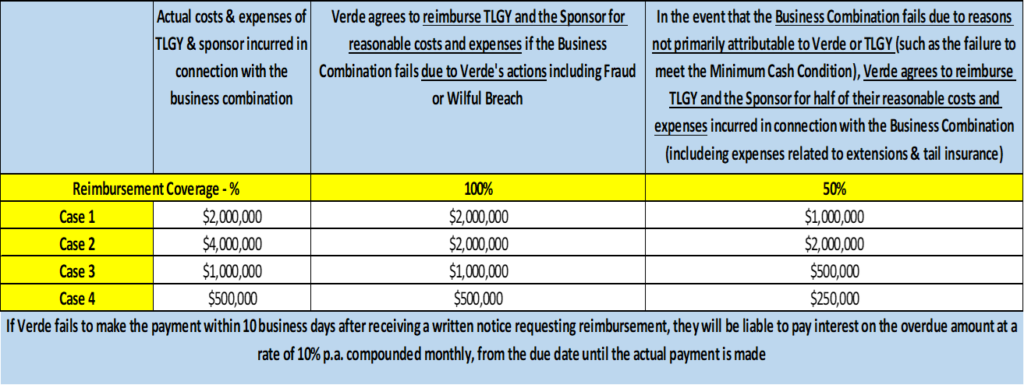

- Expenses:

- TLGY shall not be required to repay the Company Extension Loans if the transaction fails

- Verde is not responsible for reimbursing TLGY or the Sponsor for any costs and expenses if the transaction fails primarily due to actions by TLGY or the Sponsor. This includes situations where TLGY or the Sponsor breach the binding provisions of the Merger Agreement or any Ancillary Agreement, engage in fraud or willful breach, or if the Merger Agreement is terminated under certain circumstances such as:

- Mutual consent,

- TLGY’s representations or warranties are untrue, or TLGY fails to fulfill its obligations,

- There is an Acquiror Change in Recommendation, TLGY changes its recommendation to shareholders, or the Acquiror Shareholder Approvals are not obtained at the meeting

- Extension:

| Extension Period | First Extension Period – 3 Months Extension | Second Extension Period – 3 Months Extension |

| Extension Dates | If any Extension(s) is required from September 2, 2023 through December 2, 2023 | If any Extension(s) is required after December 2, 2023 through March 31, 2024 |

| Extension Loans | Verde & Sponsor shall cause one or more Company Extension Loans and Sponsor Extension Loans respectively, to be made to TLGY on a monthly basis, in each case, on an interest-free basis in an amount equal to the lower of: (a) 50% of necessary funding amount per month (b) $100,000 | Verde & Sponsor shall cause one or more Company Extension Loans and Sponsor Extension Loans respectively, to be made to TLGY on a monthly basis, in each case, on an interest-free basis in an amount equal to the lower of: (a) 50% of necessary funding amount per month (b) $150,000 |

| Extension Period Termination | In case where the Sponsor provides Verde with a written notice of its intention to terminate, then Verde shall have the option either agree to terminate or make a Company Extension Loan equal to 100% of necessary funding amount | In case where the either of Sponsor or Verde provides a written notice to the other of its intention to terminate, then Verde or Sponsor shall have the option either agree to terminate or make a Company OR Sponsor Extension Loan equal to 100% of necessary funding amount |

| Company Extension Loans | ||

| On Verde’s request, Humanitario can provide loan(s) to Verde in an equivalent amount to finance such Company Extension Loan(s)in exchange of convertible promissory note: (a) at interest of 10% p.a. (b) computed on 365/Actual basis (c) compounded monthly (d) with a right to convert all or any portion into New Verde Common Stock | ||

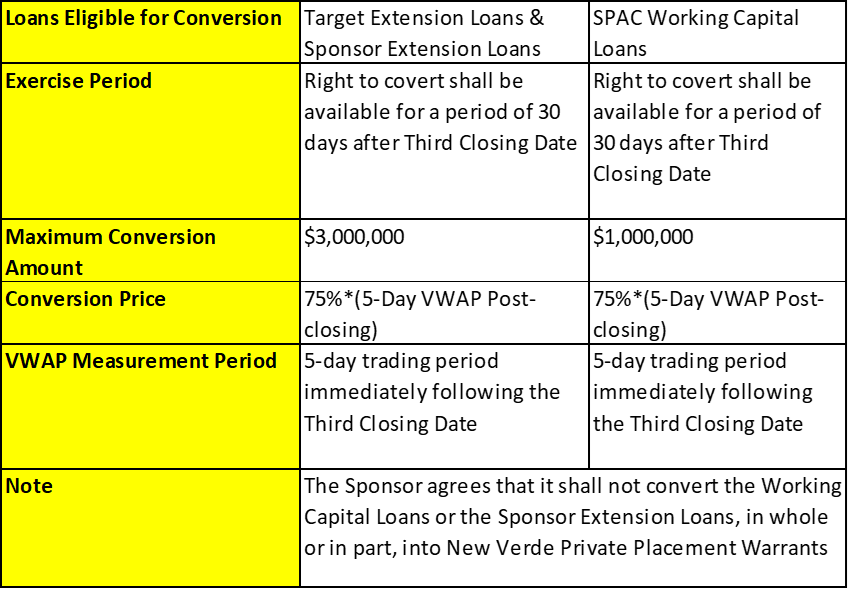

- Conversion of Company Extension Loans, Sponsor Extension Loans and Working Capital Loans:

- Equity Incentive Plan:

- As mutually decided

*Denotes estimated figures by CPC

#Estimated as on May 24, 2023 (Date of depositing extension funds to extend to July 3, 2023)