- 10X Capital Venture Acquisition Corp. III (VCXB) to acquire American Gene Technologies International (Private) in a transaction valuing the pro forma entity at *$612 million in Enterprise Value (*$654 million equity value) assuming zero redemptions from the current level of 86.4%.

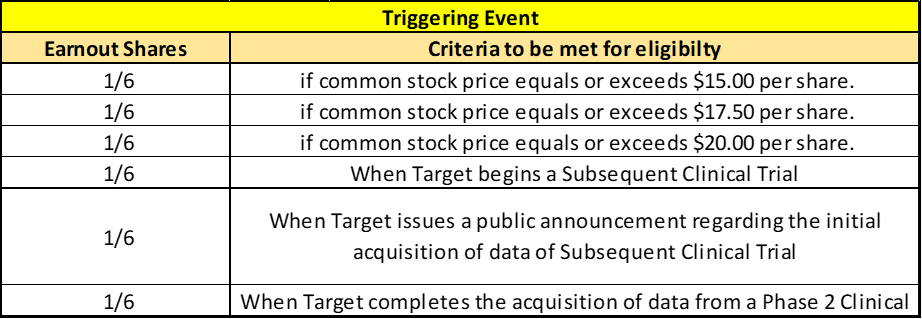

- American Gene Technologies International shareholders will receive an equity consideration of $500 million at $10.15 per share. They are also eligible to receive earnout shares worth $300 million at $10.15 per share in six equal tranches at $15.0, $17.5, $20.0 and the other three triggering events are based on clinical trials of their drugs over a period of five years.

- CF Principal Investments LLC entered in a non-binding letter of intent with SPAC related to a committed equity facility. If the definitive purchase agreement is executed, SPAC can sell up to $50.0 million shares of SPAC Common Stock.

- Minimum net cash condition of $25.0 million.

- No termination fees.

- Business combination transaction is targeted to close in the first quarter of 2024.

- SPAC Details:

- Unit Structure: 1 Class A Ordinary Share + 0.5 Redeemable Warrant

- #Cash in Trust: $42,139,444 (103.8 % of Public Offering)

- Public Shares Outstanding: 4,056,190 shares

- Private Shares Outstanding: 11,153,000 shares (including 1,153,000 shares held in private units)

- Trust Value/Share: $10.38

- Current Liquidation Date: October 14, 2023

- Outside Liquidation Date: October 14, 2023

- Name of Target: American Gene Technologies International Inc.

- Target Description: Addimmune is a leader in the pursuit of a gene therapy cure for HIV. 38 million people are living with HIV globally, with 1.2 million in the U.S. Although HIV has suitable treatments, those treatments are expensive, lifelong, and often toxic. Addimmune’s cell therapy is designed to modify a patient’s immune system so that it is capable of fighting HIV like a normal virus. It makes gene modifications to the patients’ immune cells (T cells) that harden those cells against HIV infection and depletion, thus allowing those cells to maintain a normal response to HIV instead of being “killed” by the virus. When HIV T cells survive and do their job, they fight HIV just like the immune system is able to fight a cold or flu. Jeff Galvin, CEO, and the Addimmune team have extensive experience in HIV and drug development. Addimmune’s Chief Medical Officer, Dr. Marcus Conant, MD has over forty years on the front lines of HIV treatment and research, including at University of California Medical Center in San Francisco, and Chief Science Officer, Dr. Jeffrey Boyle, PhD has over two decades leading the development of FDA-regulated drugs and medical devices. Dr. Drew Palin, MD, Addimmune’s Chief Business Officer is an experienced, serial entrepreneur and physician

- Announced Date: August 9, 2023

- Expected Close: “First Quarter of 2024”

- Press Release: https://www.sec.gov/Archives/edgar/data/1848948/000121390023065315/ea182935ex99-1_10xcapital3.htm

- Transaction Terms:

| Redemption Rate | 86.4% |

| Share Price | $10.15 per share |

| Enterprise Value | *$612 million |

| Market Cap Value | *$654 million |

- Target Shareholders Receive (~*76.41%):

- Equity consideration of $500 million at $10.15 per share (*49.26 million Acquiror Common Stock)

- Earnout consideration of $300 million at $10.15 per share (*29.56 million earnout shares) over 5 years post-closing as follows:

- PIPE / Financing:

- CF Principal Investments LLC entered in a non-binding letter of intent with SPAC related to a committed equity facility according to which:

- SPAC can sell to up to $50 million shares of 10X III Common Stock to CF Principal Investments LLC (Cantor)

- Upon SPAC’s delivery of a purchase notice, Cantor would be required to buy a specified percent of the daily trading volume of the Securities (Maximum 25%) on the day the notice is delivered

- Facility would terminate on the earlier of:

- 18 months post-closing

- Completion of all the sale of securities

- Termination by SPAC upon 10 days’ notice

- CF Principal Investments LLC entered in a non-binding letter of intent with SPAC related to a committed equity facility according to which:

- Redemption Protections:

- Nil

- Support Agreement:

- Standard voting support

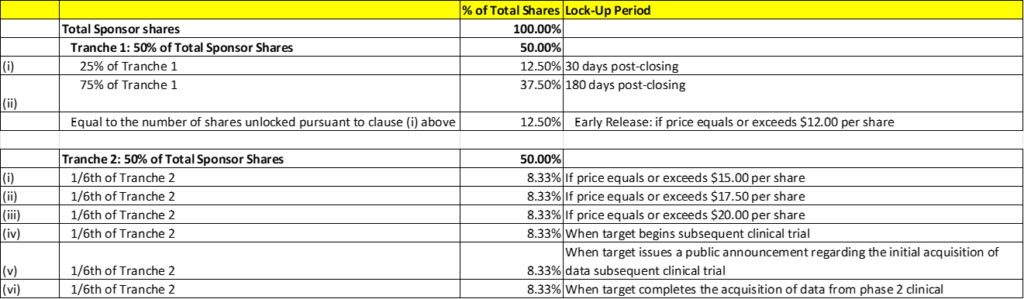

- Lock-up:

- Target Key shareholder (owner of > 0.5%): 6 months post-closing

- SPAC Sponsor: 36 months post-closing:

- Closing Conditions:

- Termination date: October 14, 2023 (can be extended if SPAC gets extension approval)

- SPAC closing indebtedness < $1.00 million

- Minimum Net Cash Condition of $25.00 million

- Cash includes:

| Cash in Trust | |

| Add: | Any Pre-Closing Financing |

| Add: | Any other cash then held by SPAC |

| Less: | Redemptions |

| Less: | Any cash fees, costs and expenses of SPAC and Target in connection with the Transactions |

- Other customary closing conditions

- Termination:

- No termination fees

- Other standard termination clauses

- Advisors:

- SPAC Legal Advisors: Latham & Watkins LLP

- Target Legal Advisors: DLA Piper LLP (US)

- SPAC Financial Advisors: Roth Capital Partners

- Comparable:

- No information provided

- Financials:

- No information provided

- Equity Incentive Plan:

- 10% of combined fully distributed shares at Closing

- Annual increase equal to the lesser of either 3% or number of shares of Common Stock determined by the Board or Compensation Committee

- 10% of combined fully distributed shares at Closing

*Denotes estimated figures by CPC

#Reported as on 31st March 2023 (From 10Q)